There’s a common refrain in customer service circles that just keeps on repeating itself. It goes: customers hate having to repeat themselves. We know this, we hear it all the time, yet we still have to keep saying it.

Because customers keep having to repeat themselves.

Of course, addressing the issue takes more than the snap of a finger. And for enterprise organizations in the financial services space, it goes beyond simply knowing who a customer is and which product(s) they use. How well you can anticipate needs, predict next-best solutions, and proactively extend a hand—this is where the rubber meets the proverbial road.

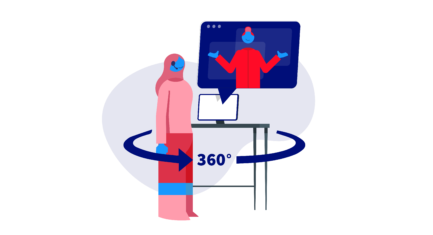

In other words, ‘customer 360’ – a concept that Salesforce uses and builds on in its Customer 360 platform to build out a comprehensive understanding of customers in the CRM.

With a customer 360 strategy in place, repeating oneself ought to be the last thing on a customer’s mind. Let’s take a closer look at what it takes to deliver customer 360 for financial services.

Clean data + tight CRM integration: the building blocks of Customer Service 360

So much of a customer 360 experience revolves around the CRM. Typically, step one requires the move toward what Snowflake calls a single source of truth—clean, consolidated, and secure customer data.

This is the critical building block upon which 360-degree experiences are built. It paves the way for meaningful CRM integrations that enable the people relying on them. Customers, first and foremost, but also operational staff, marketing, and sales.

Take b+s Connects for Salesforce, for example. This integration with Cisco Contact Center relies on impeccable customer data to put agents a step ahead at every turn. That way, each customer gets as much personalization as possible, no matter the touchpoint. Plus, these tailored experiences can be custom-built and scaled with relative ease.

With this infrastructure in place, a financial services organization using Webex Connect could ensure that its proactive and entirely personalized outreach and communications always hit the mark. An outbound messaging campaign to insured new homeowners who have yet to add earthquake protection, but who are in the vicinity of faults, for instance.

From the customer service perspective, an agent will not only know that the person they’re about to talk to on the phone has a digital checking account, has recently taken out a mortgage, and clicked a link in the offer for earthquake insurance but also that the same customer’s checking account is currently locked—the likely reason for the call.

Speaking of AI and automation, both stand to help service teams make the most of their customer data. AI in the contact center is helping:

- Automate repetitive tasks, like balance checking or appointment setting within the entire array of modern customer communication channels.

- Get customers where they need to go more efficiently, like routing to mortgage advisers with a single mention of house loans or mortgages.

- Enrich and improve chatbot experiences, with natural language and LLM making conversations more fluid than ever.

- Equip agents with proactive and personalized recommendations, like transferring calls to a more suitable adviser or highlighting an insurance upsell opportunity.

- Reduce time to serve overall, ensuring the customer is seen immediately on the channel of their choice while ensuring agent time is only used when it’s necessary.

Customer Service 360 in action: 3 use cases

From the agent/contact center perspective, customer 360 stands to significantly improve handle time, customer satisfaction, and retention. More likely than not, service-adjacent teams that also rely daily on the CRM will benefit.

Ponce Bank relied on Salesforce to build a 360-degree view of its customers. Their team consolidated 54 systems into a single platform, leading to vast improvements in data availability and visibility. As a result, Ponce Bank has been able to streamline processes between sales, marketing, and ops. Loan underwriting, deposit rate approvals—across the board, the 360 experience is increasing visibility, supporting more effective cross-selling, and informing product recommendations.

Case Study: Webex and First Horizon

Webex, Bucher + Suter’s preferred cloud contact center solution, helped First Horizon better serve its 1.1 million customers. Their implementation of Webex Contact Center allowed for the rapid onboarding of 1500 agents. On the customer side, First Horizon clients now encounter highly personalized self-service experiences at every turn. For a $1.6B company, this level of scalable service is critical to ongoing success.

Case Study: Bucher + Suter and Siemens Company Health Insurance Fund (SBK)

SBK is one of the world’s largest statutory health insurance providers, covering more than one million people. With the help of Bucher + Suter, the company aimed to roll out seamless service across all touchpoints—a comprehensive 360° customer view—based on the following process improvements:

- Improving accessibility and reducing unsuccessful calls

- Detailed insights into call routing, including wait times, previous connections and agent availability

- Enhanced company-wide transparency through extensive monitoring

- Implementing a standardized phone system across all locations

The result has been an across-the-board reduction of average processing times, increased availability for support personnel, and better data security.

Case Study: Bucher + Suter and Global Insurer

Another global insurer needed to ensure technically seamless customer service for 122 million customers in over 70 countries worldwide with the insurer’s more than 15,000 agents. Together with Bucher + Suter, this large enterprise, identified the CAI platform from Cognigy as best capable to meet their criteria, as follows:

- Agnostic deployment, scalable, data security, GDPR compliant

- Easy integration with in-house developed CRM

- Cloud-native, strong international manufacturer, large customer base

- Language support, global hosting variants

- Top NLU, telephony and contact center integration

As a result of this move toward 360-focused contact center infrastructure, this global insurer was able to decrease average handle time by 27%, across 15 million automated customer dialogues.

Customer Service 360—worth the investment?

These are but three examples of global financial companies making significant investments in customer 360. What we’ve found with the Bucher + Suter implementations, in particular, is that the benefits of a centralized, cloud-first contact center experience extend beyond efficiency gains.

Because these implementations require data quality and integrations with existing systems, other service-adjacent teams stand to benefit. This typically comes in the form of highly relevant product recommendations and upsell/cross-sell opportunities, first and foremost. Speaking broadly, most financial services find that the strength of their brand improves as well.

Are customer-first automations, improved agent capabilities, and considerable operational efficiency gains worth the investment in customer 360 infrastructure? Perhaps the better question is, can your organization afford to do without?